Terror Data Suspense Upgrades! The gold market is facing directional choices

- May 16, 2025

- Posted by: Macro Global Markets

- Category: News

On Thursday morning (May 15th), the Asian market held its breath as it awaited the release of the US retail sales data for April (commonly known as the “terror data”) at 20:30. The current market expectation is that the monthly data rate will only increase by 0.3%, but several economists warn that due to the impact of tariff policies, declining consumer confidence, and inflation stickiness, the actual data may fall short of expectations, leading to severe fluctuations in the financial market.

1、 Data background: Double shadow of tariff shock and weak consumption

The lagging effect of tariff policy is evident

The “equivalent tariffs” imposed by the Trump administration on imported goods since March have gradually spread to the end consumer market. According to data from the US Department of Commerce, the price index of imported goods in April increased by 3.2% year-on-year, with tariff sensitive categories such as automobiles and electronic products rising by over 5%. Although the implementation of the US China tariff agreement has temporarily eased some pressure, there are still variables in the US tariff negotiations with trading partners such as the EU, Japan, and South Korea. Companies are generally delaying price increases to observe policy trends, which may lead to weak retail sales data in April due to suppressed demand.

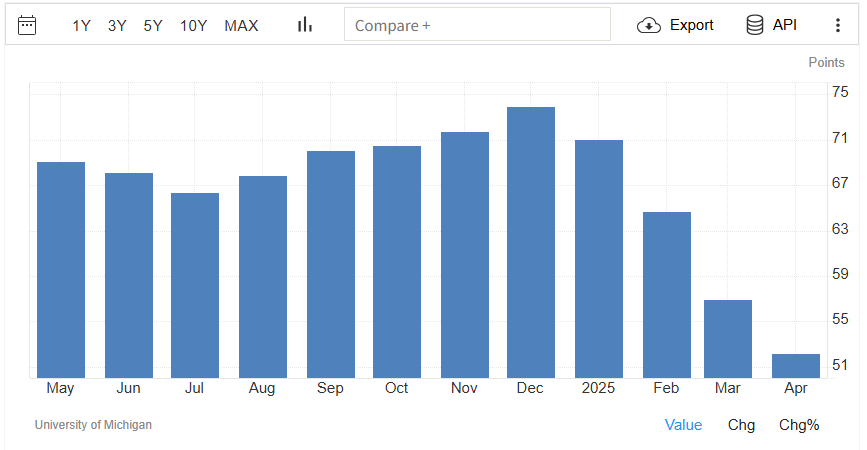

Consumer confidence and spending capacity both decline

The Federal Reserve’s Consumer Confidence Index fell to 52.2 in April, the lowest level since November 2023, reflecting the suppression of residents’ willingness to consume by the high interest rate environment and debt pressure. In addition, non farm employment added 175000 people in April, which was higher than expected, but the salary growth rate slowed down to 3.4%, and the actual purchasing power directly affected retail spending.

Deviation between historical data and market expectations

Although the monthly retail sales rate in March surged by 1.4% due to sudden consumption before customs duties, the April data may fall due to demand overdraft. Economists generally predict that the monthly retail sales rate in April will only be 0.1%. If the data is lower than expected, it will exacerbate market concerns about an economic “soft landing”.

2、 Potential risk: chain reaction that may be triggered by data explosion

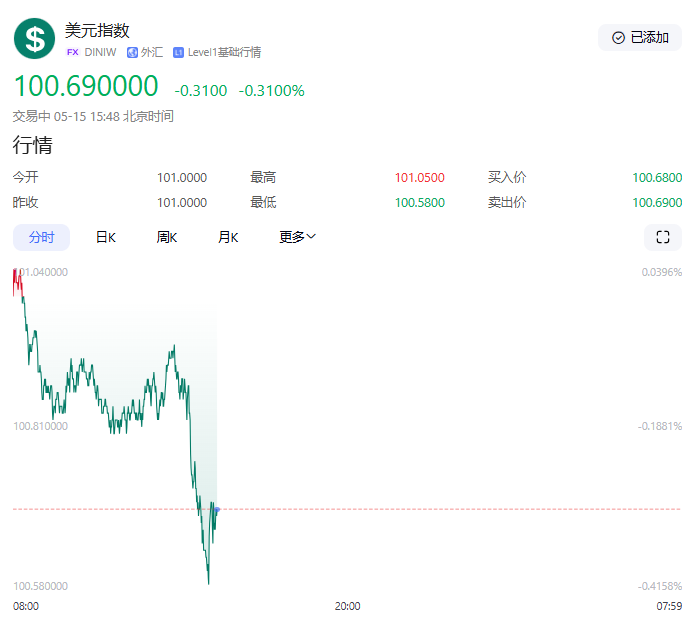

The inverse volatility of the US dollar and US Treasury bonds

The US dollar index plummeted overnight from a high of 101.04 to 100.69. At the same time, if the 10-year US Treasury yield falls below the key level of 4.5%, it will reduce the cost of holding gold and drive the rebound of gold prices.

Switching between market sentiment and capital flow

If the data is weak, US tech stocks may face profit taking pressure, and funds may flow back from the stock market to safe haven assets such as gold. The holdings of the world’s largest gold ETF (SPDR) have decreased for three consecutive days, but if the data explodes, it may trigger short covering and increase daily positions by more than 10 tons.

3、 Impact on the gold market: technical level falls below

Technical breakthrough and oversold repair

Spot gold fell below the key support level of $3200 per ounce overnight, forming a “guillotine” pattern at the daily level, with a short-term downward target of $3136 (61.8% Fibonacci retracement level). However, on the 14th, the RSI index fell to 38.5, entering the oversold range. The 15 minute chart showed a bottom divergence signal, indicating strong demand for technical rebound.

Tonight’s’ terrifying data ‘will be a key turning point in the long short game of the gold market. If the data falls short of expectations, gold may experience an oversold rebound; If the data is strong, the gold price may further decline to $3150.