Trump sends additional National Guard soldiers to Los Angeles, amid constitutional crisis and rising demand for safe haven in the gold market

- June 11, 2025

- Posted by: Macro Global Markets

- Category: News

1、 The situation in Los Angeles is escalating

On June 9th local time, US President Trump announced the deployment of 2000 additional National Guard soldiers to Los Angeles in response to ongoing riots caused by immigration law enforcement conflicts. This deployment is a further intervention by the Trump administration in the situation in California, following the first deployment of 2000 National Guard personnel on the 7th. As of June 10th, 1700 National Guard soldiers and 700 Marine Corps soldiers have been deployed in the Greater Los Angeles area, with a focus on protecting federal agencies and personnel.

Escalation of Conflict and Constitutional Controversy: The incident originated from a large-scale illegal immigration search operation launched by the US Immigration and Customs Enforcement (ICE) in Los Angeles on June 6th, which resulted in 44 arrests and sparked street violence. Protesters engaged in physical altercations with law enforcement officers, throwing stones and water bottles, while the police used tear gas and rubber bullets to disperse the crowd. Trump bypassed California Governor Newson and directly mobilized the National Guard, triggering a constitutional crisis. California Attorney General Rob Bonta has filed a lawsuit accusing the Trump administration of “unlawful overreach” and requesting the court to revoke the deployment order.

Political games and social divisions: The Trump administration’s move has been criticized as “creating chaos to shift political pressure”. California Governor Newson pointed out that only 300 of the first 2000 deployed National Guard personnel actually participated in the operation, while the rest were idle in the federal building, purely a “political show”. Los Angeles Mayor Bass emphasized that federal intervention has exacerbated community fear, while local police had the ability to control the situation. This conflict has exposed the deep-seated contradictions between federal and state immigration policies, as well as social rifts such as racial conflict and economic anxiety.

The above picture is a statement from the Northern Command

2、 Short term risk increase in gold

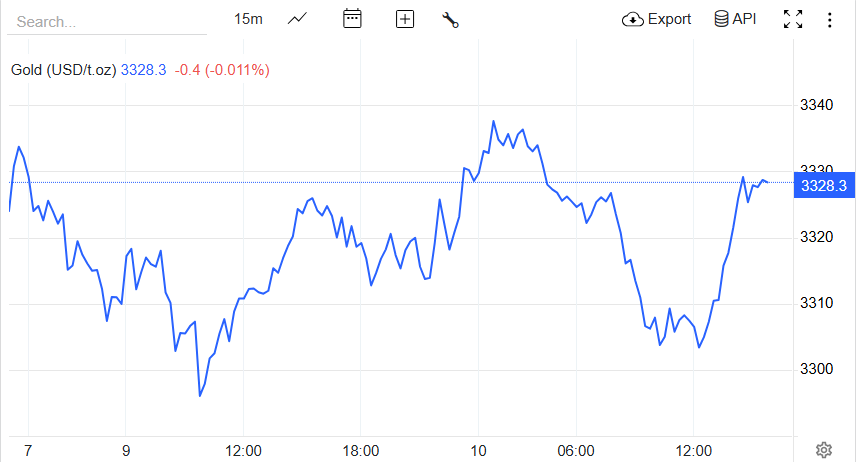

Short term boost in gold price due to safe haven demand: The escalation of violent conflict in Los Angeles coupled with constitutional crisis has driven up demand for gold as a safe haven asset. On June 10th during the Asian session, spot gold continued to fluctuate at a high level, with London gold suddenly rising around $20 to fluctuate around 3330 at noon. Geopolitical risk premium has become a supporting factor for gold prices, and the market is concerned that the event may spread to other cities, triggering nationwide turmoil.

The dual effect of the trend of the US dollar and the Federal Reserve’s policies: Although the US dollar index rebounded to 99.2058 in the Asian session on June 10, the market still has expectations for the Federal Reserve to cut interest rates. Federal Reserve Governor Waller previously stated that if core inflation continues to move towards the 2% target, there may be a rate cut later this year, and the long-term low interest rate environment is favorable for gold. However, in the short term, the strengthening of the US dollar still exerts pressure on gold prices, and attention should be paid to the policy signals of the FOMC meeting on June 17-18.

The potential impact of China US trade negotiations: The first meeting of the China US Economic and Trade Consultation Mechanism currently being held in London has become another key variable. If negotiations make progress, it may alleviate market concerns about tariff escalation and reduce the demand for inflation hedging in gold; On the contrary, if negotiations break down, geopolitical risks combined with trade frictions will further push up gold prices.

Although the June meeting of the Federal Reserve in Los Angeles may release hawkish signals, coupled with the Trump administration’s fiscal expansion policy, if inflationary pressures exceed expectations, it may change the long-term upward logic of gold. Investors need to be alert to liquidity shocks caused by sudden news, and it is recommended to control positions and set stop losses.