ADP hits a two-year low! US dollar plummets, gold surges, expectations of interest rate cuts ignite bull frenzy

- June 6, 2025

- Posted by: Macro Global Markets

- Category: News

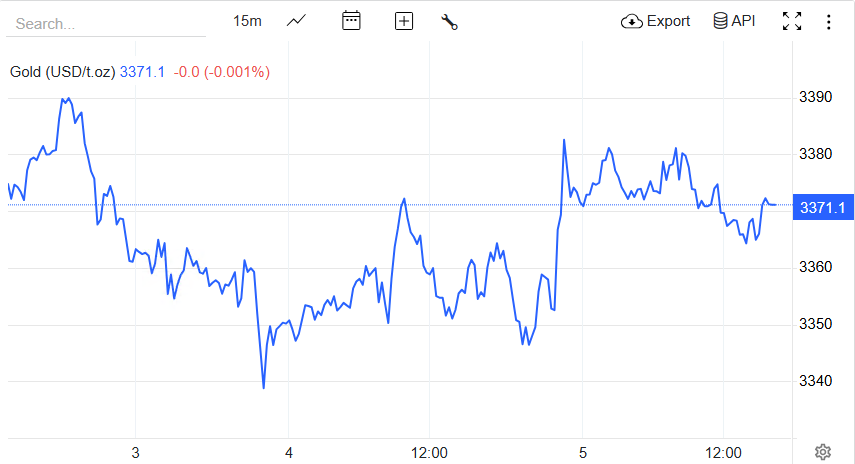

On the evening of June 4th Beijing time, the May ADP employment data (commonly known as “small non farm payroll”) in the United States shocked the market with 37000 new jobs, only one-third of the expected 110000, marking the lowest growth rate since March 2023. After the data was released, the US dollar index plummeted by 20 basis points in the short term, briefly falling below the 99 level to 98.9783, while spot gold surged by $6 to $3354.52 per ounce, highlighting market concerns about the economic outlook and the surge in safe haven demand. Combined with the US May ISM services PMI falling to 49.9 (the first contraction in nearly a year) released on the same day, and the policy shock of the Trump administration raising steel and aluminum tariffs to 50%, gold bulls are experiencing multiple positive resonances.

1、 Small scale agricultural data ‘hits’ the US dollar, with expectations of interest rate cuts intensifying

The weakness of ADP data this time far exceeds market expectations. Previously, the market generally predicted that private sector employment would increase by 110000 in May, but the actual number was only 37000, and the April data was revised down from 80000 to 60000, indicating an accelerated cooling of the labor market. After the data was released, the financial market reacted quickly: the US dollar index fell to 98.9783, hitting a new low in nearly three months; The 10-year US Treasury yield plummeted by 0.58% to 4.421%, reflecting investors’ growing concerns about slowing economic growth.

Institutions interpret this as’ the engine of the labor market stalling ‘. ADP Chief Economist Neira Richardson pointed out that “recruitment activities are slowing down across a wide range of industries, particularly in manufacturing and construction, as companies shrink their recruitment plans amid tariffs and economic uncertainty. More noteworthy is that although the JOLTS job vacancy data for April shows that the labor market is still resilient (7.4 million), the proportion of 1.03 jobs per unemployed person has dropped to the lowest level since the pandemic, indicating that the supply-demand imbalance has eased and the pressure on wage growth has weakened.

This data directly strengthens the market’s expectation of the Federal Reserve cutting interest rates. The CME Fed Watch tool shows that the probability of a rate cut in September has increased from 75% before the data was released to 87%, and some traders are even betting that the June 19 meeting may release clearer signals of easing. Federal Reserve Governor Cook warned before the data was released that tariffs could push up inflation and reverse the recent downward trend in inflation, but the market is more concerned about the coercive effect of labor market weakness on policies.

2、 Shrinking service industry+tariff impact, highlighting the safe haven nature of gold

The US May ISM Services PMI released on the same day further exacerbated market panic. The index plummeted from 51.6 in April to 49.9, marking the first time since June 2024 that it has fallen below the boom bust line. The new orders index also plummeted 5.9 points to 46.4, the largest decline in nearly two years. In the sub item data, the payment price index jumped to 68.7 (the highest since November 2022), indicating that the cost pressure on enterprises is still accumulating, while the employment index fell from 50.2 to 49.2, confirming the deterioration of the labor market.

At the same time, the Trump administration officially implemented the policy of raising steel and aluminum tariffs to 50% on June 4th, triggering global trade uncertainty. Despite exempting some allies such as the UK, the EU has stated that it will take countermeasures and may launch retaliatory tariffs on July 14th. Tariff policies not only increase manufacturing costs, but may also be transmitted through the supply chain to the consumer end, further suppressing economic vitality.

In this context, gold, as a traditional safe haven asset, is being sought after by funds. On Wednesday (June 4th), spot gold closed up 0.56% at $3372.18 per ounce, reaching a high of $3384.52 per ounce during trading, setting a new two-week high. Technically speaking, the daily gold price has stabilized at the 50 day moving average, the RSI index has rebounded to 55, and the MACD red bar has re amplified, indicating the recovery of bullish momentum.

3、 Outlook for the future: Non farm data becomes a key variable

Although market expectations for interest rate cuts are heating up, the non farm payroll data to be released on Friday (June 6) remains a key variable. At present, the market expects a non farm payroll increase of 125000 people in May, and the unemployment rate to remain at 4.2%. If the data is also weak, it may further strengthen the expectation of interest rate cuts, driving gold to launch an impact towards $3400; On the contrary, if it is not for the agricultural sector exceeding expectations, it may trigger a reassessment of the resilience of the labor market in the market, leading to a short-term correction in gold prices.

The explosion of data from small non farmers and the contraction of the service industry, combined with the impact of tariff policies, have ignited the enthusiasm of gold bulls. In the short term, gold is expected to challenge the $3400 mark driven by expectations of interest rate cuts and safe haven demand, but we need to be cautious of the volatility caused by non farm payroll data exceeding expectations. In the medium to long term, the opening of the Federal Reserve’s interest rate cut cycle and the intensification of global economic uncertainty will continue to make gold play the role of the “king of crisis hedging”.