From ‘Vanguard of Interest Rate hikes’ to’ Policy Spectator ‘: How tariffs rewrite the Fed’s interest rate cut script?

- April 27, 2025

- Posted by: Macro Global Markets

- Category: News

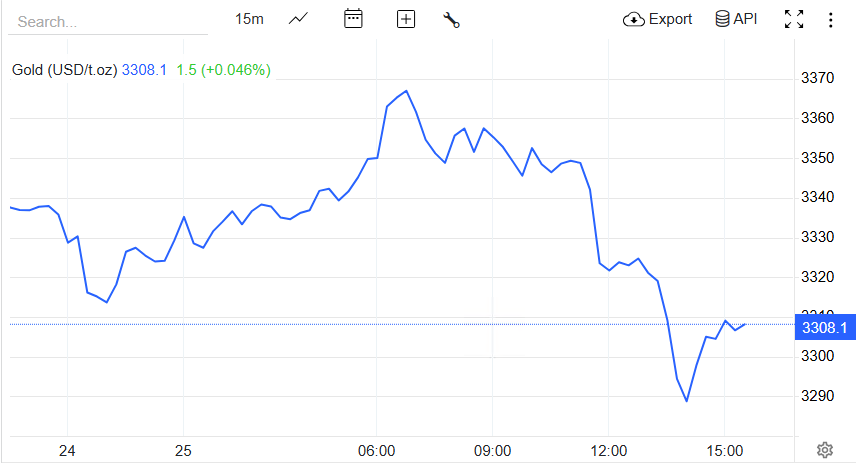

On April 25th, senior officials of the Federal Reserve made intensive statements, clearly stating that there is no need to adjust monetary policy at present, and the interest rate remains unchanged in the range of 4.25% -4.5%. Behind this’ pause button ‘is the dual pressure of the’ stagflation ‘risk caused by the Trump administration’s tariff policies and the crisis of the Federal Reserve’s independence. Despite the market’s increasing expectations of interest rate cuts, Powell faces a difficult balance between “controlling inflation” and “stabilizing growth”, making it difficult to release signals of easing in the short term. Affected by this, the gold market has shown a roller coaster trend, with intraday fluctuations exceeding $20.

1、 Federal Reserve’s’ pause key ‘: Policy determination in data chaos

The tariff effect lags behind, and policy wait-and-see has become a consensus

Federal Reserve Governor Waller and Cleveland Fed President Hamack both emphasized that the economic impact of the 104% tariffs imposed by the Trump administration on China on April 9 will not be apparent until the summer at the earliest, so the possibility of an immediate policy shift is extremely low. Waller pointed out that tariffs may only trigger a “one-time price increase,” but a contraction in consumption and a decline in employment will partially offset inflationary pressures, and “the final inflation rate may be lower than market expectations. This judgment forms a subtle contradiction with the New York Fed’s prediction that “tariffs may raise inflation to 4% by 2025,” highlighting the Fed’s cautious attitude towards data.

Internal Game: Inflation Priority vs. Growth Concerns

Powell made it clear in his speech on April 16th that “without price stability, there can be no sustainable job market,” implying that if inflation conflicts with employment targets, the Federal Reserve will prioritize controlling inflation. But Goldman Sachs warns that tariffs could lead to a sharp drop in US GDP growth to 0.5% and an increase in unemployment to 4.7%, forcing the Federal Reserve to oscillate between “hawkish wait-and-see” and “dovish easing”. The minutes of the March FOMC meeting showed that officials’ discussions on the risk of “stagflation” have heated up, but most still advocate “waiting for clearer signals”.

Political pressure and legal deadlock

Trump has repeatedly pressured the Federal Reserve to cut interest rates in recent times, even threatening to dismiss Powell, but on April 22, he changed his statement to “have no intention of firing” in an attempt to ease market volatility. On a legal level, the Federal Reserve Act stipulates that the chairman can only be dismissed for “justifiable reasons,” and the precedent cited by Trump in the Humphrey case is facing a challenge from the Supreme Court. Wall Street warns that if the independence of the Federal Reserve is compromised, it could trigger a sell-off of US dollar assets and a crisis of confidence in fiat currency.

2、 Tariff Wars: The ‘Black Swan’ of the Global Economy

The escalation of trade frictions impacts the supply chain

After the United States imposed a 104% tariff on China, China quickly retaliated by raising tariffs on US imports to 84%, and the European Union suspended retaliation against US tariffs for 90 days. This policy directly impacts the global supply chain, driving up the cost of goods such as furniture and building materials, and exacerbating consumer financial pressure. Goldman Sachs pointed out that if the tariff war continues, US companies may lay off employees and the Federal Reserve may be forced to cut interest rates to protect the job market.

The prominent feature of economic stagflation

In March, the sales of second-hand houses in the United States experienced the largest decline since 2022, but house prices rose by 2.7% year-on-year, indicating a stagflation signal of “volume contraction and price increase”. At the same time, the monthly rate of durable goods orders surged by 9.2% in March, and the short-term recovery of the manufacturing industry and weak consumption coexisted, further complicating the Federal Reserve’s decision-making.

The credit rift of the US dollar and the acceleration of “de dollarization”

Trump’s tariff policies have caused the US dollar index to depreciate by nearly 10% this year, and global central banks have increased their holdings of gold for 18 consecutive months, with China’s central bank reserves reaching 2268 tons. Goldman Sachs believes that the US dollar is still overvalued by 20%, and trade protectionism will weaken the excess performance of the US economy, which will be negative for the US dollar in the long run.

3、 The gold market: a double-edged sword in the long short game

Financial Trends: Risk Avoidance Demand and Speculative Differentiation

The holdings of SPDR Gold Trust, the world’s largest gold ETF, increased to 948.56 tons, and the Shanghai Gold ETF had a net inflow of 169 million yuan in the past 7 days, indicating the preference of institutional and individual investors for safe haven assets. But COMEX gold futures long positions have decreased, and short-term profit taking pressure still exists.

Institutional Outlook: Short term Fluctuations and Long term Bulls

Goldman Sachs maintains its year-end gold price target of $3700, emphasizing the long-term support of central bank gold purchases and US dollar credit risk; UBS believes that if geopolitical risks ease, gold prices may drop to $3200.

The current Federal Reserve is caught in a dilemma of “tariffs driving up inflation” and “slowing economic growth,” while Trump’s political pressure further exacerbates policy uncertainty. Gold, as a tool for de dollarization and an anti inflation asset, highlights its allocation value in the face of stagflation risks and geopolitical turbulence. In the medium to long term, the contraction of US dollar credit and the trend of central bank gold purchases have not changed, and the “de dollarization” attribute of gold remains the core support. A pullback is an opportunity for layout.