In depth analysis of the May 2025 non farm payroll report: Employment resilience supports economic expectations, while gold faces short-term pressure and long-term opportunities remain

- June 10, 2025

- Posted by: Macro Global Markets

- Category: News

1、 Non farm Summary – Total Data Analysis

The May non farm payroll data released by the US Department of Labor on June 6th showed that 139000 new jobs were added, slightly higher than the market expectation of 130000, but slower than the revised 147000 in April. The unemployment rate has remained stable at 4.2% for the third consecutive month, in line with expectations. The salary growth rate exceeded expectations, with an average hourly wage increase of 3.9% year-on-year and a month on month increase of 0.4%, indicating that labor cost pressure still exists.

From the perspective of industry structure, the healthcare and leisure hotel industries contributed the main increase in jobs (126000), while the manufacturing and retail industries decreased by 8000 and 6500 jobs respectively, reflecting the impact of trade policy uncertainty on the real economy. It is worth noting that the non farm payroll data for March and April were significantly revised downwards, with a total decrease of 95000 people, offsetting the positive side of the May data, indicating a marginal weakening of the labor market momentum. Overall, the job market remains resilient, but the slowdown in growth and industry differentiation have intensified concerns about the economic outlook.

2、 The impact of the release of small non farm ADP data on the market of large non farm sectors

In May, ADP’s private sector employment only increased by 37000 people, the lowest level in more than two years, far below the expected 115000 people, reflecting a significant decrease in the willingness of companies to recruit due to trade policies. After the release of ADP data, the market’s expectations for non farm payrolls were significantly lowered, and the US dollar index fell in the short term. Gold rebounded at one point due to rising expectations of interest rate cuts. However, the unexpected big non farm payroll data reversed market sentiment: the US dollar index surged 0.45% to 99.19, reaching a new high in nearly three months; The yield on 10-year US Treasury bonds jumped 11 basis points to 4.51%, indicating a cooling of market expectations for the Fed’s policy shift.

This expectation gap led to a rapid decline in gold prices after the non farm payroll announcement, dropping from an early high of $3354 per ounce to $3307 per ounce and ultimately closing down 1.2%. The market logic has shifted from “economic weakness → rising expectations of interest rate cuts → rising gold prices” to “employment resilience → policy wait-and-see → gold pressure”, highlighting the high volatility of market sentiment during data sensitive periods.

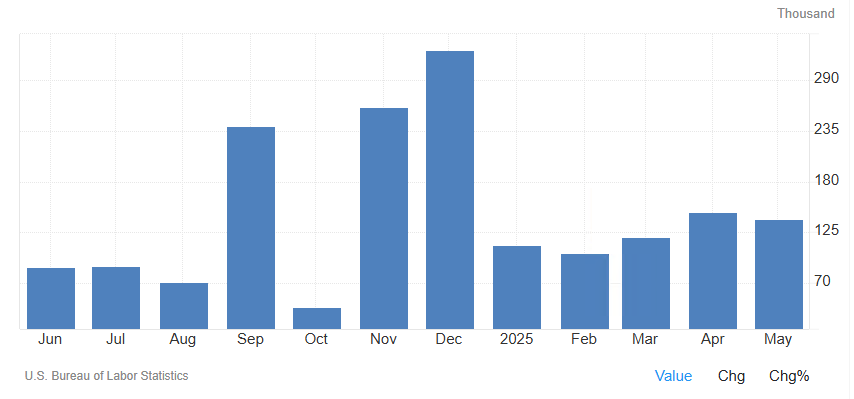

3、 Trend analysis of historical non farm payroll data release

From a time series perspective, the US non farm employment market is showing a moderate cooling trend:

In May 2025, 139000 new jobs were created (previously 147000), the unemployment rate was 4.2%, and hourly wages increased by 3.9% year-on-year.

In April 2025, 147000 new jobs were created (previously 177000), the unemployment rate was 4.2%, and hourly wages increased by 3.9% year-on-year.

In March 2025, 120000 new jobs were created (previously 185000), the unemployment rate was 4.2%, and hourly wages increased by 3.8% year-on-year.

Core features:

The number of newly added jobs has been below 150000 for three consecutive months, indicating a cooling of the labor market, but the unemployment rate remains low, reflecting that the contraction of labor supply may offset the impact of declining demand.

Although the hourly wage growth rate has slightly declined, it is still higher than the Federal Reserve’s target, strengthening concerns about inflation stickiness and constraining expectations of interest rate cuts.

The data correction is significant, with a total decrease of 95000 people in non farm payroll data for March and April, highlighting the lag and complexity of employment market statistics.

4、 Opinions of relevant institutions

Fuguo Group: The overall employment report is positive, indicating that the labor market remains stable. The stable unemployment rate and higher than expected wage growth may prompt the Federal Reserve to remain on the sidelines, reducing the probability of interest rate cuts in the short term.

ANNEX Wealth Management: The data appears positive on the surface, but details reveal issues such as extremely low manufacturing diffusion index, concentrated employment growth in a few industries, and questionable economic resilience.

CITIC Securities: Despite strong short-term data, the mild weakening trend in the job market has not changed. It is expected that the Federal Reserve will cut interest rates no more than 2 times this year, which may be implemented at the September interest rate meeting.

Sparta Securities: The report has limited impact on the market, and although salary growth has attracted attention, it is not enough to change the Federal Reserve’s policy path. Gold is under short-term pressure but supported by central bank gold purchases in the long run.

5、 The trend and future speculation of gold prices after the non farm payroll release

Short term trend: After the release of non farm payroll data, gold prices fell from $3354/ounce to $3307/ounce, closing down 1.2%, showing a bearish technical outlook. The hourly level has fallen below the central structure, and the 15 minute level has strong downward momentum, with short-term support moving down to $3270 per ounce.

Future speculation:

Upward risk: If subsequent economic data (such as CPI, PMI) show a decline in inflation or an accelerated deterioration of the job market, expectations of interest rate cuts may restart, driving gold to rebound. The continuous purchase of gold by global central banks (such as China’s central bank increasing reserves for seven consecutive months) provides long-term support for gold prices.

Downward pressure: If the Federal Reserve maintains a hawkish stance and US dollar and Treasury yields continue to strengthen, gold may drop by $3200 per ounce. In addition, a rebound in risk appetite (such as progress in trade negotiations) may divert safe haven funds.

Risk Warning: Geopolitical conflicts, the speed of the Federal Reserve’s policy shift, and the pace of global central bank gold purchases are key variables that require close monitoring of subsequent data and events.