Initial tariff impact: US June CPI rebounds year-on-year beyond expectations, gold under pressure to fall

- July 17, 2025

- Posted by: Macro Global Markets

- Category: News

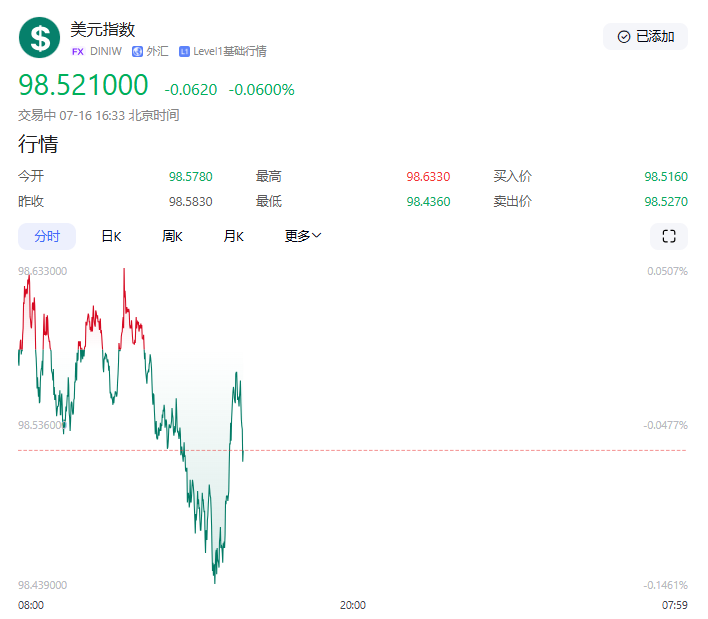

On July 16th, spot gold trading in the Asian market was around $3340 per ounce. The US dollar index rose for the fourth consecutive trading day, hitting a high of 98.70 on Tuesday, reaching a new high since June 23 and closing at 98.616. The yield of the US 10-year treasury bond bond rose to 4.487%, the highest level since June 11, and the 30-year yield hit a six week peak of 5.022%.

1、 The resonance between tariff shocks and inflation data

According to data released by the US Bureau of Labor Statistics on July 15th, the Consumer Price Index (CPI) rose 2.7% year-on-year in June, exceeding market expectations by 2.6%, marking the largest increase since February this year; The month on month increase was 0.3%, consistent with expectations but higher than the previous value of 0.1%. The core CPI increased by 2.9% year-on-year, which was in line with expectations but higher than the previous value of 2.8%. The month on month increase of 0.2% was lower than the expected 0.3%. The data shows that the Trump administration’s tariff policies have begun to be transmitted through the supply chain to the end consumer sector.

Tariffs affect the following data levels:

1. The prices of imported goods have risen: due to the impact of tariffs imposed by the United States on countries such as the European Union and Indonesia, furniture prices increased by 1% month on month in June, toy prices increased by 1.8%, and clothing and footwear prices rose simultaneously. The Associated Press analysis pointed out that this is the first time since the implementation of tariff policies in 2024 that the inflation effect of imported goods has been significantly reflected in CPI data.

2. Energy price rebound: In June, energy prices rose by 0.9% month on month, reversing the previous decline of -1.0%. Among them, gasoline and fuel prices “turned from decline to rise”, directly driving CPI to increase by 0.15 percentage points month on month.

The EU’s countermeasures are on the verge of being implemented. On July 14th, the European Commission released a retaliatory tariff list worth 72 billion euros (approximately 84 billion US dollars), covering categories such as Boeing aircraft, cars and parts, and bourbon whiskey. It will be submitted to the EU Council for a vote on July 16th. If the United States and Europe fail to reach an agreement before August 1st, countermeasures will officially take effect. French President Macron called on EU companies to suspend investment in the United States, while member states such as Ireland, which rely heavily on exports to the US, advocated cautious responses, further revealing internal rifts within the EU. The International Monetary Fund (IMF) warns that if a full-scale trade war breaks out between the US and Europe, global GDP growth may decline by 0.8%, threatening 12 million jobs.

2、 Differentiation of Federal Reserve Policy Expectations and Market Reactions

The intensification of monetary policy game:

Although the overall CPI exceeded expectations year-on-year, the slowdown in the month on month growth rate of core CPI provided a buffer space for the Federal Reserve to maintain current interest rates. Federal funds rate futures show that the market expects a rate cut of about 44 basis points before the end of the year, with the probability of a rate cut in September dropping from 80% to 53%. On July 15th, Federal Reserve Chairman Powell stated during a congressional hearing that “the impact of tariffs on inflation has a lag effect and needs to be observed for subsequent data,” implying that interest rates will not be adjusted in the short term.

The dual suppression of the US dollar and US bonds:

The US dollar index broke through the 50 day moving average of 98.80s and accelerated its upward trend, approaching the 100 integer level. The weakening of non US currencies indirectly suppressed gold prices. The 10-year US Treasury yield rose to 4.487% after breaking through 4.4%, reflecting the market’s adjustment of inflation expectations. The breakeven inflation rate has risen to 2.5%, indicating investors’ concerns about long-term inflation. The high-yield environment has weakened the attractiveness of gold as an interest free asset, but the rising supply chain costs caused by tariffs may provide potential support for gold prices.

The current gold market is at a critical juncture of multiple contradictions: short-term tariff shocks and the strengthening of the US dollar suppress gold prices, while geopolitical risks and central bank purchases provide hedging support.