Outlook for Non Farm payroll Data in June 2025: Employment Landscape in the Mist

- July 1, 2025

- Posted by: Macro Global Markets

- Category: News

1、 Introduction to Non Farm Farming – Data Complexity and Market Gaming

As the core observation indicator of the Federal Reserve’s monetary policy, the fluctuation of US non farm employment data not only reflects the health of the labor market, but also directly affects the global asset pricing logic. The current market is in a critical period of the game between “high inflation stickiness” and “hidden concerns about economic slowdown”. The performance of non farm payroll data in June will further verify the cooling pace of the labor market and affect the pricing of the Federal Reserve’s expectation of interest rate cuts in September. It is worth noting that the previous value has been revised downwards by 95000 people, and the deviation between the recent non farm data and market expectations has significantly increased. For example, although the non farm data added 139000 people in May exceeded expectations, there is a risk of statistical correction in the previous data itself.

In addition, the controversy over the investigation methods of the Ministry of Labor, such as overestimating the number of newly added jobs in enterprises, has also exacerbated the complexity of data interpretation. For the gold market, long and short signals in non farm payroll data often trigger severe fluctuations. For example, after the May data was released, the gold price was under pressure for a while, but then due to the rise in unemployment and the slowdown in wage growth, the market’s expectation of interest rate cuts heated up, driving the gold price to rebound.

2、 Interpretation of Small Non Agricultural ADP and Large Non Agricultural ADP

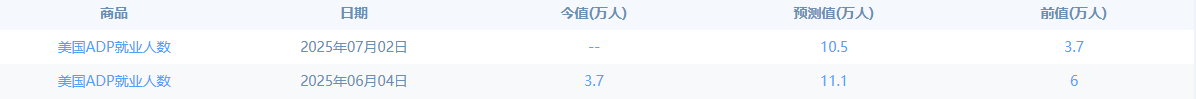

Small Non Agricultural ADP Outlook

Pre value and forecast: ADP employment increased by 37000 in May, the lowest growth rate in five months, indicating a significant cooling of private sector recruitment willingness. The market predicts that ADP may rebound to 105000 in June.

Market impact: If the ADP data is lower than expected, it may strengthen the signal of weak labor market, promote the expectation of Fed interest rate cuts to heat up, and benefit gold; On the contrary, if the data is strong, it may briefly boost the US dollar and suppress gold prices.

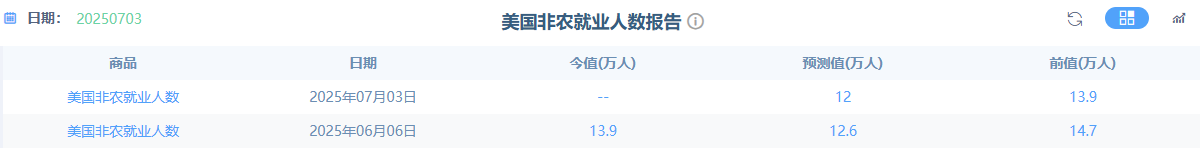

Core indicators for non-agricultural sectors

Pre value and forecast: 139000 new non farm workers were added in May, with an unemployment rate of 4.2%. Hourly wages were 0.4% month on month and 3.9% year-on-year. The market expects an increase of 120000 non farm workers in June, with the unemployment rate slightly rising to 4.3% and hourly wages at 0.3% month on month and 3.8% year-on-year. But there are significant institutional differences, with Goldman Sachs predicting 140000-160000 people and Wells Fargo being even more pessimistic at 115000 people.

The impact of last month’s data on gold prices: After the release of non farm payroll data in May, gold fell under short-term pressure to $3250, but later rebounded above $3300 due to rising unemployment rates and slower wage growth, which raised market expectations of a Fed interest rate cut.

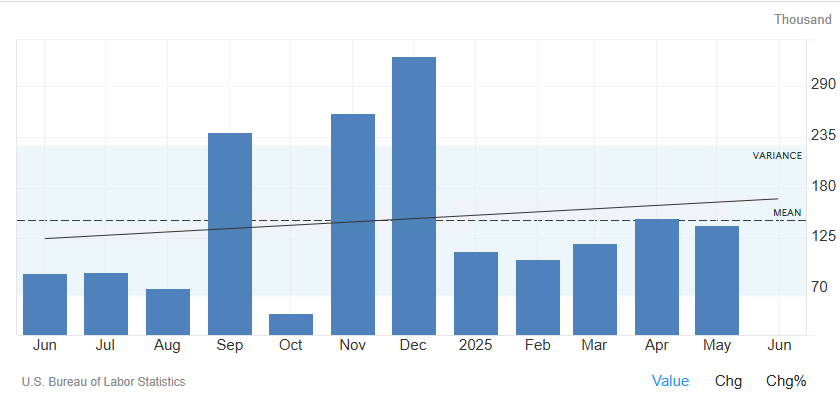

3、 Review of Historical Non Agricultural Data

According to data from the US Department of Labor, the initial value of non farm new employment in March 2025 is 228000, the unemployment rate remains at 4.2%, and hourly wages increased by 0.3% month on month and 3.8% year-on-year; The data for April was significantly revised down to 117000 people, with the unemployment rate still at 4.2%. The hourly wage growth rate slowed down to 0.2% month on month and 3.7% year-on-year; In May, non farm payroll added 139000 people, exceeding expectations but with a cumulative decrease of 95000 people. The unemployment rate remained unchanged at 4.2%, and hourly wages rebounded to 0.4% month on month and 3.9% year-on-year. The data shows the characteristic of “slowing down employment growth but still maintaining wage resilience”, reflecting the uncertainty of the cooling pace of the labor market.

4、 Differentiation between institutional forecasts and market expectations

Mainstream institutional perspectives

Goldman Sachs: It is expected that there will be 140000-160000 new non farm payroll jobs in June, with an unemployment rate of 4.3% and a slowdown in hourly wage growth to 3.8%. It is believed that the labor market will cool down but not stall.

Fuguo Bank predicts an increase of 115000 people and an unemployment rate of 4.3%, emphasizing the suppressive effect of tariff shocks and government recruitment freezes on employment.

Bank of America: Expected to add 150000 people, with an unemployment rate of 4.2%, indicating that the resilience of service industry employment may support data exceeding expectations.

Market median: 69 institutions predict a median increase of 130000 people, an unemployment rate of 4.2%, and a month on month hourly wage of 0.3%.

Key contradiction points

Controversy over data authenticity: There is a significant difference in employment data between the Corporate Survey (CES) and the Household Survey (CPS), with the former showing 2.8 million new jobs added in the past year and the latter only 216000, suggesting that actual employment growth may be between the two.

Salary inflation correlation: If the hourly wage growth rate remains above 3.8%, it may strengthen inflation stickiness expectations and slow down the pace of the Federal Reserve’s interest rate cuts; On the contrary, if hourly wages weaken, it may exacerbate concerns about economic recession.

5、 Trading Reminder: The Long Short Logic and Strategy of Non Farm Market Trends

Gold market strategy

Scenario analysis:

Non farm payroll growth>200000, unemployment rate<4.2%: Strengthening the hawkish stance of the Federal Reserve, bearish on gold.

Non farm growth<150000, unemployment rate>4.3%: Expectations of interest rate cuts rise, bullish for gold.

6、 Non farm weekly important data and events

ISM Manufacturing PMI (July 1st)

Prediction: Market expectation is 50.5, with a previous value of 48.5. If it rebounds to the expansion range (>50), it may alleviate concerns about economic recession and be negative for gold.

Impact logic: There is a high correlation between manufacturing employment and non farm payroll data. If the PMI employment index rebounds, it may indicate strong non farm performance in advance.

US Senate votes on ‘Big Beautiful Bill’ (before July 4th)

Core content: It involves tax relief, debt ceiling adjustment, and immigration policies. If passed, it may alleviate government debt risks and boost the US dollar in the short term; If production is difficult, it may trigger market concerns about fiscal deadlock, which is beneficial for gold.

Speech by Federal Reserve Officials (July 2-3)

Focus of attention: Powell and other members of the voting committee’s statements on inflation and employment may set the tone for non farm payroll data in advance if they release dovish signals.

The June non farm payroll data will become a key milestone in verifying the narrative of a “soft landing” for the US economy, and the market needs to focus on the synergy of employment growth, unemployment rate, and wage changes. For gold, it is suppressed in the short term by hawkish expectations from the Federal Reserve and cooling risk aversion, but still benefits from global central bank gold purchases and the risk of a US economic recession in the medium to long term. Investors should flexibly adjust their positions and strictly control risks based on actual data performance.