Putin’s plane is surrounded by 46 drones! Russia-Ukraine conflict escalates

- May 27, 2025

- Posted by: Macro Global Markets

- Category: News

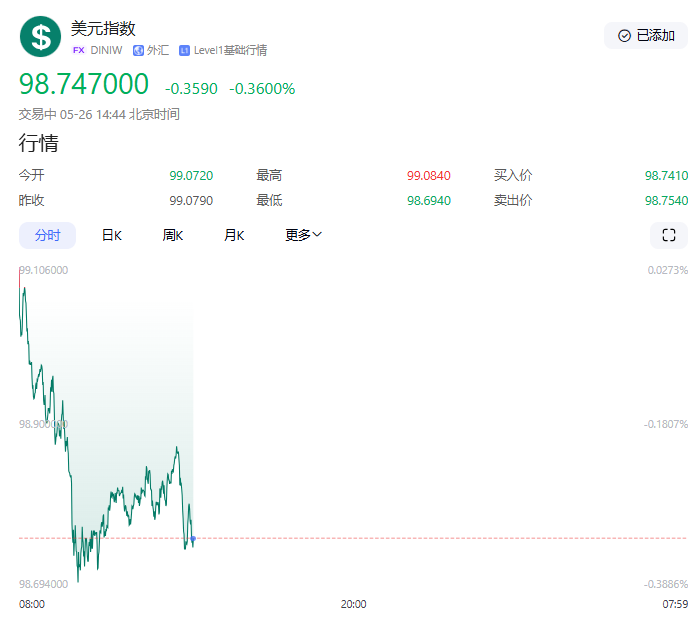

International spot gold surged by $12 in the short term, breaking through $3350 per ounce and now trading at $3342.54 per ounce. Due to the joint disclosure by Russian media and the Kremlin on the 25th that “Ukrainian drones surrounded Putin’s plane” last Tuesday, the Russian military launched the “largest airstrike in three years” on Kiev, with 367 drones and missiles attacking together, resulting in at least 87 deaths. The geopolitical risk premium surged instantly, with the panic index VIX jumping 15% to 26.3, the US dollar index falling 0.5% to 98.62, and gold safe haven buying demand exploding.

1、 The Attack on Putin’s Special Plane: the “Most Dangerous Escalation” of the Russia-Ukraine conflict

On May 25th, the Russian Kursk Air Defense Division’s Dashkin disclosed for the first time that on May 20th, during Putin’s inspection of the front line, the Ukrainian military deployed 46 drones to “precisely besiege” the presidential helicopter route, and the Russian military shot down all targets within a 20 kilometer radius. The Russian side accused that the attack was “intelligence accurate to the minute” and suspected of internal leaks, while the Ukrainian side denied planning the assassination, stating that “the drones were only targeted at military objectives”.

The three major signals of conflict escalation:

Russian retaliatory bombing: On May 25-26, the Russian military launched a joint attack on Kiev using “Shahid drones+Dagger missiles”, destroying three energy facilities and causing flames in residential areas. The Ukrainian Air Force has confirmed that this is the “largest single day airstrike” since the 2022 conflict, with a record 367 attacks.

The Western attitude has changed: NPR in the United States acknowledges that the scale of the attack shocked Washington, and the Trump administration has suspended peace talks and considered imposing additional sanctions on Russia. On the 26th, the European Union announced the 19th round of sanctions against Russia, freezing the assets of 127 officials.

Reversal of battlefield situation: The Russian military took advantage of the situation and announced on the 26th the occupation of three settlements in Donetsk, establishing a “drone defense buffer zone”. Ukrainian think tank ISW assessment: “Putin is expanding the eastern occupation zone under the pretext of ‘protecting the homeland’

2、 Gold Market: The ‘Nuclear Explosion Level’ Reaction of Geopolitical Risk Premium

1. The demand for hedging suddenly surged

The T+D premium of China Gold has expanded to+4.1 yuan/gram, indicating that domestic funds are rushing to raise funds. The Shanghai Gold Exchange sold over 120000 lots in just 15 minutes.

According to historical data, every time the Russia-Ukraine conflict escalates to level 1 (such as an attack on a leader), the average gold price increases by 1.8% in 24 hours. This event may push the gold price to exceed 3380 dollars.

2. Accelerated support for de dollarization

The Russian central bank announced on the 26th that it will increase the proportion of gold in foreign exchange reserves to 28%, setting a new historical high. China’s gold imports in April were 127.5 tons (+73% year-on-year), with a continued increase in holdings to 2294 tons. The World Gold Council pointed out that “geopolitical risks are forcing central banks to accelerate ‘de dollarization’, and global central bank gold purchases may exceed 1300 tons by 2025

3、 Trend Outlook: From ‘Local Conflict’ to ‘Systemic Crisis’

The attack on Putin’s special plane marks that the Russia-Ukraine conflict has entered a sensitive period of “summit security”, and gold’s risk aversion has upgraded from “regional conflict” to “global governance crisis”. The yield on US Treasury bonds fell to 4.518% on the 26th, reflecting market concerns about “conflict spillover” – if NATO intervenes directly, gold may break through $3500.