The lower than expected US CPI triggered expectations of interest rate cuts! Gold skyrockets, 10-year US Treasury yield falls below 4.5%

- June 13, 2025

- Posted by: Macro Global Markets

- Category: News

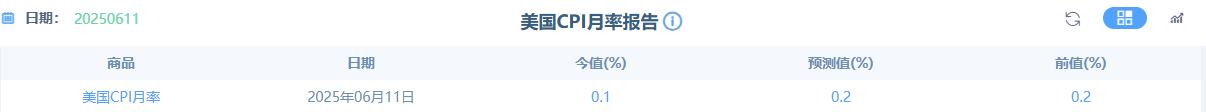

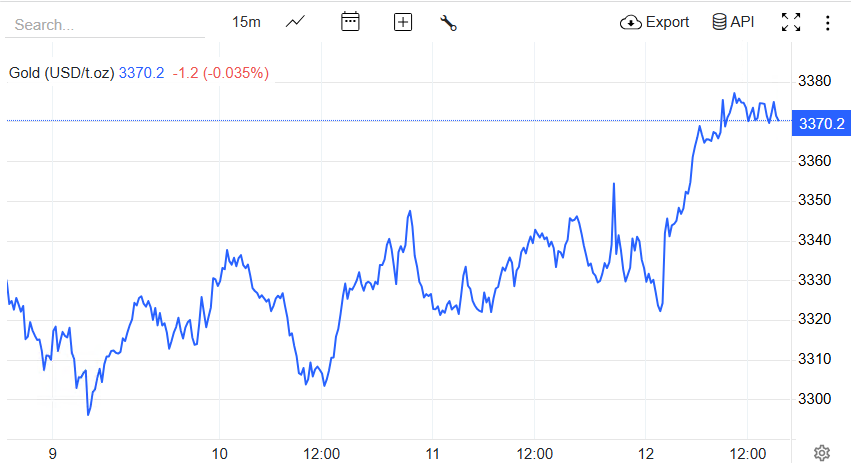

On the evening of June 11th, the US Department of Labor released May CPI data, with a total CPI of 2.4% year-on-year (expected 2.5%) and a core CPI of 2.8% year-on-year (expected 2.9%). The month on month increase was only 0.1% (expected 0.2%), both lower than market expectations. After the data was released, spot gold surged by $12 to $3376.3 per ounce in the short term (the highest in the Asian session on June 12th), reaching a new high for the week; The yield on 10-year US Treasury bonds plummeted by 5 basis points to 4.38%, and market expectations for the Fed to cut interest rates twice this year have risen to 72%.

1、 CPI ‘cooling’ exceeds expectations, interest rate cut game intensifies

The core highlight of this CPI data is the loosening of inflation stickiness:

The prices of goods have fallen across the board: new car (-0.3%), used car (-0.5%), and furniture (-0.8%) prices have fallen month on month, indicating that the Trump administration’s 25% car tariff has not yet been transmitted to the retail end, easing supply chain pressure.

The growth rate of service inflation has slowed down: housing rent has remained stable at 0.4% month on month (previously 0.5%), and medical service prices have remained unchanged, ending 18 consecutive months of increases, confirming the suppression of wages by the cooling labor market.

Energy drag is significant: gasoline prices fell by 1.2% month on month, offsetting a 0.3% increase in food prices, becoming the main reason for the lower than expected total CPI.

The market reaction was intense: After the data was released, the CME Federal Reserve observation tool showed that the probability of a 50 basis point interest rate cut in September increased from 18% to 31%. Although the June 19 interest rate meeting is highly likely to be “inactive”, Powell’s policy wording has become the focus. Goldman Sachs Chief Economist Harzus bluntly stated, “The CPI data has opened a window for the Federal Reserve to ‘flexibly cut interest rates’, and we maintain our forecast of two interest rate cuts within the year. ”

2、 Gold and US Treasuries Rise Together: Risk Avoidance Resonance with Policy Expectations

Gold: Safe haven demand+double click on interest rate cuts

After the data was released, London gold was reported at $3370 per ounce, with a net inflow of $120 million (ETF funds) for the day, due to:

nterest rate cuts reduce holding costs: The weakening of the US dollar (99.02) directly enhances the attractiveness of gold denominated in non US currencies.

Geophysical risk superposition: the escalation of the Russia-Ukraine conflict (Russia launched 83 drone attacks on a single day), the intensification of nuclear deterrence in the Middle East, and the promotion of risk aversion and demand buying. According to data from the World Gold Council, global gold ETF holdings increased by 18 tons in the first 10 days of June, with the People’s Bank of China increasing its holdings for seven consecutive months to 73.83 million ounces.

US Treasury: Recession trading heats up

The 10-year US Treasury yield has fallen below the 4.5% mark, while the 30-year yield has simultaneously declined to 4.72%, reflecting market concerns about an economic recession

The manufacturing industry continues to shrink: In May, the ISM manufacturing PMI fell below 50 for the 10th consecutive month, with a new orders index of 45.5 (the lowest in nearly three years).

Hidden concerns in the service industry: Although the ISM service PMI barely rose above 50 (50.1) in May, the new orders index was 46.4, hitting a new low since November 2023.

3、 Market risk: lag effect of tariffs

Tariff transmission risk: Although the May CPI did not reflect the impact of automobile tariffs, the retaliatory tariffs imposed by the European Union (involving $2.2 billion in US goods) that came into effect on June 1 may push up inflation in the third quarter.

Geopolitical variables: If progress is made at the Middle East Peace Conference (June 15), the demand for safe haven may quickly decline, and we need to be wary of the “buy expectations, sell facts” market trend.

The expectation of interest rate cuts ignited by the US CPI data has formed a “golden cross” with geopolitical risks, driving gold prices to break this week’s high. However, we need to be wary of policy fluctuations after the data honeymoon period. In the short term, we should focus on the support of $3360 and the resistance of $3400, and in the medium to long term, we are optimistic about the structural bull market under the trend of central bank gold purchases and de dollarization.